The Upper West high-rise overlooking Berlin’s bustling Kurfürstendamm shopping boulevard is one of many glittering trophies in the portfolio of Rene Benko’s collapsing Signa, but its robust valuation reflects how much pain is in store in the cleanup of the real estate empire.

Despite turmoil triggered by the end of the cheap-money era, the 35-story tower was still valued at more than €700 million ($760 million) at the end of last year, according to a report prepared by broker Jones Lang LaSalle Inc. in April and seen by Bloomberg News. That’s a whopping 45 times the building’s rent, when multiples in the 20s are now more typical.

“An up-to-date valuation for Signa would very likely produce a fall of around a third,” said Peter Papadakos, head of European research at Green Street’.

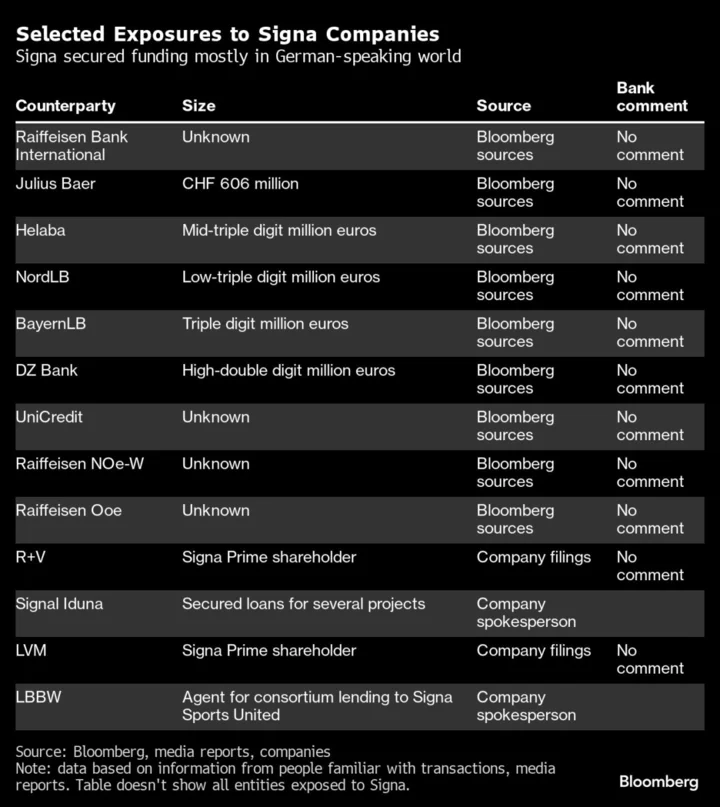

Differences between book values and what buyers are actually willing to pay are of little issue in a booming market. But with a queue of creditors desperate to get their money back, forced sales by Signa are a possibility, and the reality check could put some loans at risk and have widespread implications as deals reset the broader market.

Signa’s implosion highlights the extent to which Germany is becoming the epicenter of Europe’s commercial real estate crisis. While Benko’s group is based in Austria, much of its portfolio is in Europe’s largest economy, where the property market was seen as a safe haven until recently. When interests were at rock-bottom levels, the country’s growing economy and anemic construction meant rents and values were rising rapidly, luring investors like Benko to bid up prices.

Read More: German Real Estate Seeing Most Distress, Greystar CEO Says

The country’s banks, which got less bruised by the real estate meltdown in the global financial crisis, helped fuel dealmaking. German lenders were still routinely offering mortgages of as much as 80% of a building’s value, compared with about 60% in the UK, according to research by Bayes Business School. That might now set the country up for a harsh downturn.

German property debt is now being sold in secondary markets between 30 cents and 70 cents on the euro. “That’s big revisions,” Green Street’s Papadakos said. “We are not talking about rounding errors.”

With his lavish lifestyle and host of billionaire backers, Benko came to epitomize the excess. Signa’s vast yacht Roma was conspicuously moored at this year’s Mipim property conference in Cannes, while the Signa display at the Expo Real trade fair in Munich this October was among the largest — rates for which start at more than €225,000 not including construction costs.

Read More: Signa Founder Goes From High-Flying Billionaire to Wealth Blowup

The company’s valuations speak to that bullishness. A report prepared by BNP Paribas Real Estate for a property leased to Signa’s Galeria department-store chain — also under creditor protection — deliberately ignores the perilous state of its tenant.

“The valuation has been based on the special assumption that the tenant operates the department store until the lease contract expires,” the disclaimer said, adding that calculating for a default “was explicitly not desired by the lender and the financing bank.”

BNP and JLL declined to comment. A representative for Signa didn’t respond to a call and an email seeking comment.

As Germany’s real estate boom took hold, Signa’s valuations soared and with it Benko’s wealth. KaDeWe, which Signa bought from investors including Goldman Sachs Group Inc. for $450 million in 2012, was valued at $1.6 billion at the end of last year.

While the soaring book values allowed Signa to take on more debt, the sharp yields ascribed to the portfolio meant it generated relatively little free cash. And for a company with a vast development pipeline at a time when construction costs were rising sharply, that proved fatal.

That’s now a problem for its creditors. Completed properties generate rent that can be used to service debt, giving lenders leeway to prepare for orderly sales. But half-built projects, like Hamburg’s Elbtower, are a burden.

The Upper West was a successful project for Benko. The gleaming white tower was part of a revitalization of Berlin’s so-called City West near the Zoologischer Garten train station. Completed in 2017, about half the site is offices. It also offers retail space and houses a discount Motel One hotel.

But even after Russia’s invasion of Ukraine caused inflation to accelerate to its highest level in decades, Signa’s appraisers saw that the Upper West had lost little of its luster. The latest valuation equates to a net initial yield of 2.2% on its annual rental revenue of €16.4 million. By contrast, Berlin prime office yields are currently almost 4%, according to data from Green Street.

That means valuations are under pressure, or rents have to keep pace to offset the higher returns demanded by investors to justify the risk. To be sure, the rents paid by Upper West’s tenants are now below levels commanded by the best Berlin offices, meaning there is room for increases when contracts expire.

Valuations are inherently backward looking. Recent deals usually signpost where prices are going. But German commercial real estate transactions have collapsed to such an extent that it’s difficult to get a clear picture.

Just €15.1 billion was invested in the sector in the first nine months of the year, a 64% decline on the same period a year earlier, according to data compiled by Avison Young. Office deals have fallen even more sharply, accounting for just €3.5 billion, down from a five-year average of €18.7 billon. That means yield assumptions could still rise further, which would be a blow for Signa and its creditors.

Upper West, for instance, has a €300 million mortgage. At one time that reflected a manageable loan-to-value ratio of less than 50%. Now it’s unclear how much, if any, headroom there would be between the outstanding value of the loan and the price the property might fetch at auction.

“The private real estate world has been much less forthcoming in correcting their valuations,” Papadakos said. “So that’s where I think the pain will be.”

--With assistance from Marton Eder and Boris Groendahl.